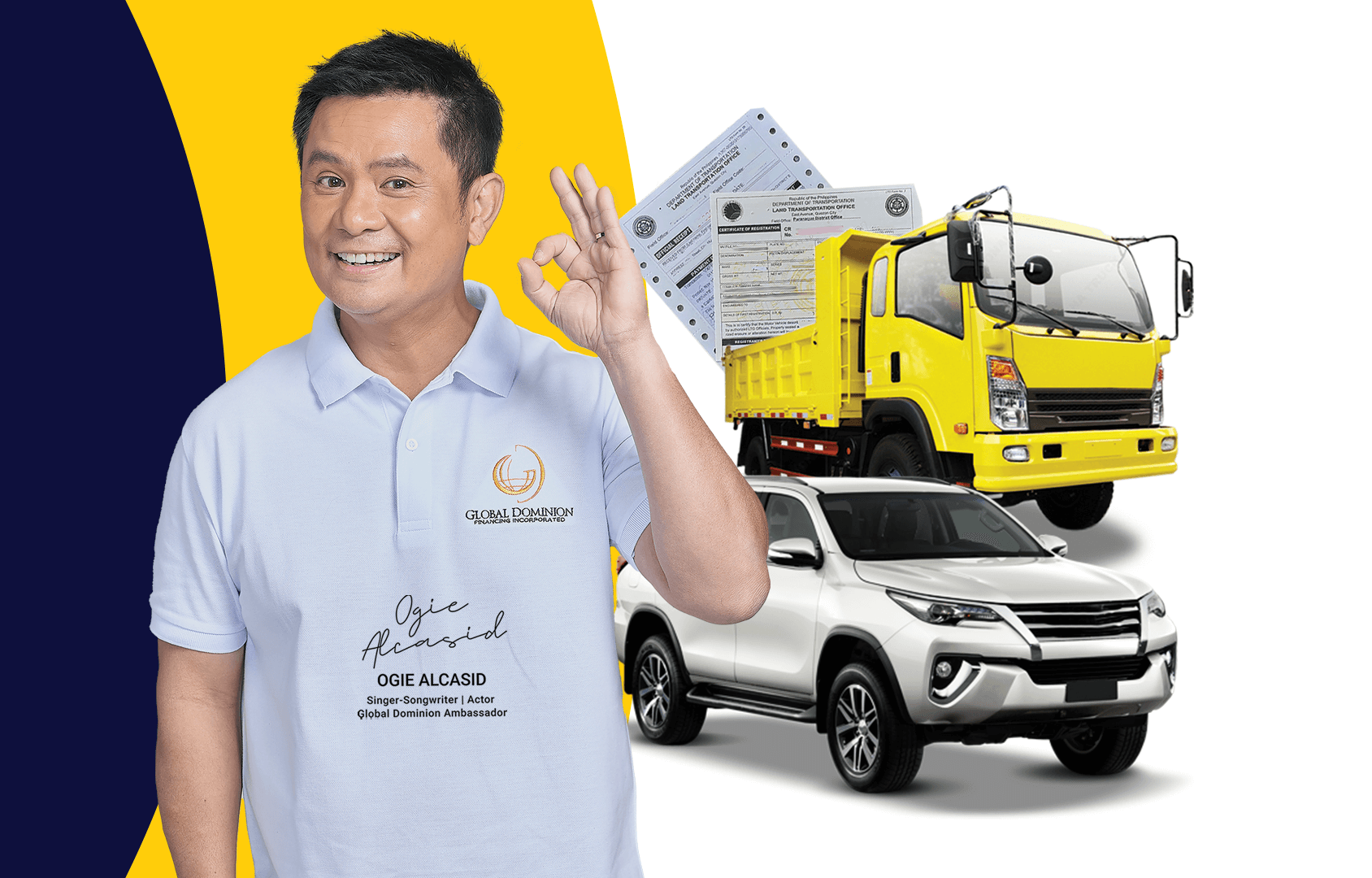

When urgent financial needs arise, one of the fastest ways to get cash is through an ORCR Sangla Loan. This type of loan allows you to use your vehicle’s Official Receipt (OR) and Certificate of Registration (CR) as collateral, without having to surrender your car. It’s a practical ORCR sangla loan for car owners who need quick funds but still want to keep using their vehicle.

To ensure smooth processing and approval, it’s important to know the requirements you need to prepare before applying. Here’s a guide to help you get ready:

1. Basic Personal Requirements

Lending companies need to verify your identity and capability to repay. Typically, you will be asked to present:

Valid government-issued IDs (e.g., driver’s license, copyright, UMID, etc.)

Proof of income (latest payslips, employment certificate, or business permits if self-employed)

Proof of billing (electric, water, or internet bill under your name or residence address)

2. Vehicle Documents

Since the loan is secured using your car’s OR and CR, you must have complete and updated records:

Original Official Receipt (OR) and Certificate of Registration (CR) issued by the LTO

Updated registration (no expired records)

Photocopies of OR/CR for submission

Deed of Sale (if the vehicle is under your name recently)

3. Vehicle Condition and Photographs

Some lenders may also require:

Clear photos of your car (front, sides, rear, and plate number)

Information about your car’s make, model, and year

Proof of insurance (if available)

4. Additional Requirements (Case-to-Case Basis)

Depending on the lender, they may also ask for:

Bank statements (last 3–6 months)

Residence certificate or barangay clearance

Co-maker or guarantor (for certain applicants)

Tips to Speed Up Approval

Ensure your OR/CR is under your name to avoid delays.

Settle any unpaid traffic violations or penalties before applying.

Keep your documents organized in both original and photocopy form.

Choose a trusted lending company with transparent terms and reasonable interest rates.

Final Thoughts

Applying for an ORCR Sangla Loan can be a quick and convenient way to access emergency funds, but preparation is key. Having the right requirements ready will not only make the process smoother but will also increase your chances of fast approval.

If you’re planning to apply soon, start gathering these documents so you can get your loan processed without unnecessary delays.